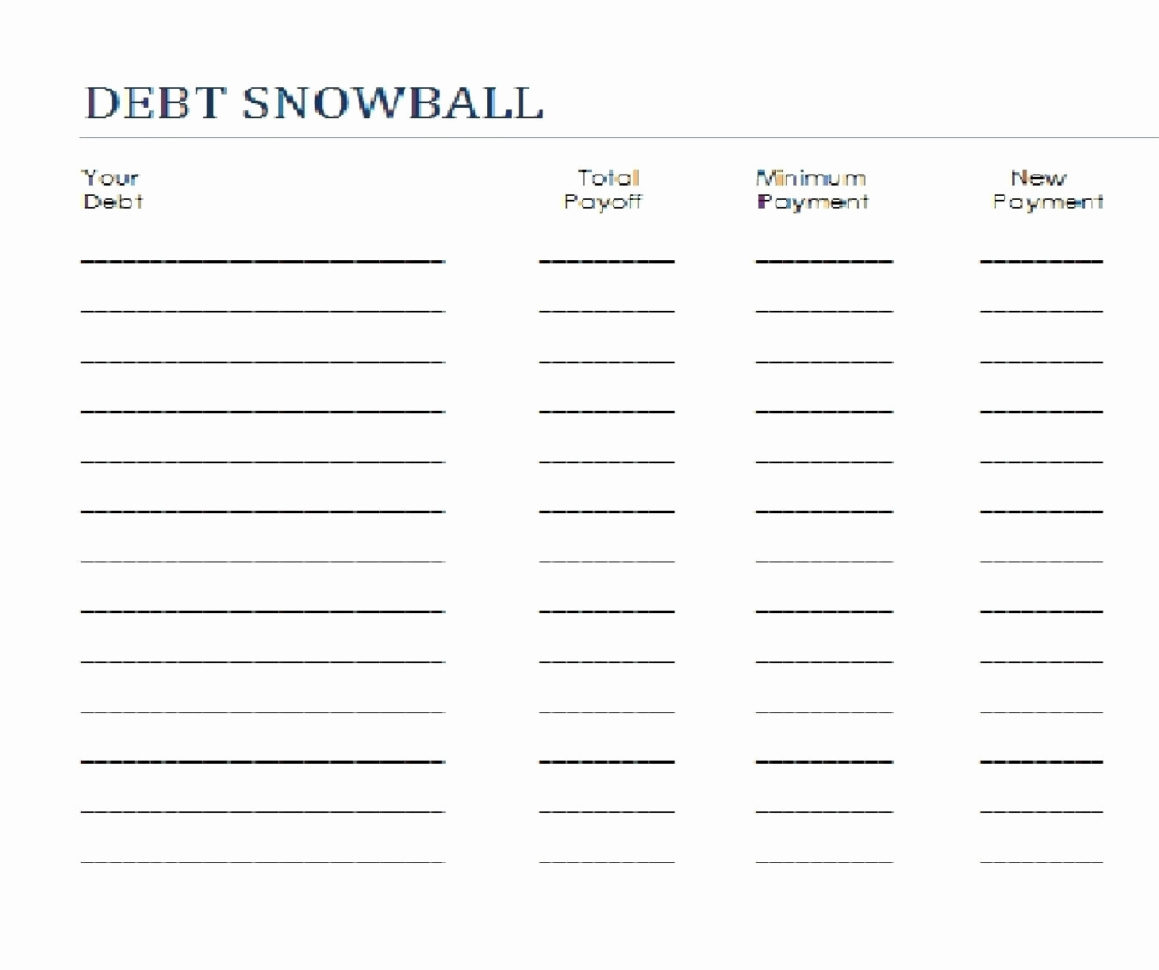

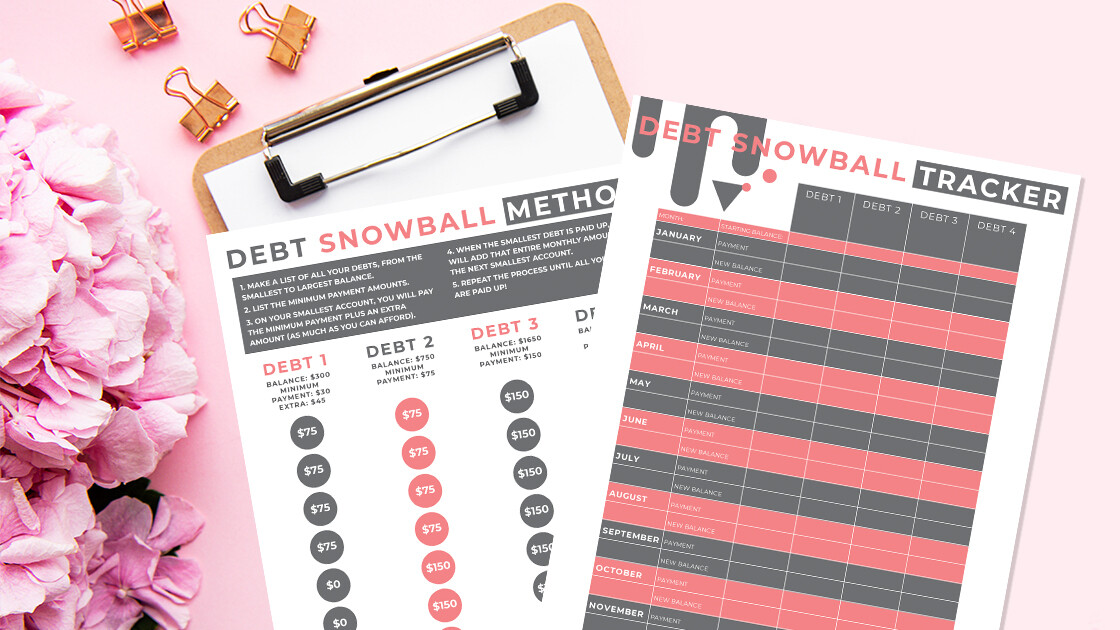

Dave Ramsey Debt Snowball Printable - Here’s how the debt snowball works: Make minimum payments on all your debts except the smallest. Web here’s how the debt snowball method works: Keep reading and at the end of the post. Here you will list all of your debts from smallest to. List your debts from smallest to largest (regardless of interest rate). Pay as much as possible on your smallest debt. All you need to do is download and print the debt snowball tracker worksheets. Web the fine print smart money happy hour. Just make your minimum payments and rebuild your emergency fund as fast as you can.

Debt Snowball Printable Dave Ramsey Debt Snowball Tracking Sheet Debt

Web the fine print smart money happy hour. Keep reading and at the end of the post. Once your emergency fund is back to $1,000,.

Debt Snowball Tracker printable This Dave Ramsey style "snowball

Pay off all debt (except the house) using the debt snowball. Web the debt snowball method is the best way to get out of debt..

Dave Ramsey Snowball Worksheets Debt snowball, Debt snowball

Dave ramsey rachel cruze ken coleman dr. Web the fine print smart money happy hour. Web here is an example of step 1: You should.

Dave Ramsey Snowball Debt Templates in Printable, Excel and PDF

All you need to do is download and print the debt snowball tracker worksheets. Web the debt snowball, made famous for being part of dave.

Debt Snowball Printable Sheet Dave Ramsey Inspired Debt Snowball Sheet

Web the debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt.

How to Pay Off Debt Using the Debt Snowball Method — Living that Debt

Once that debt is gone, take its payment and apply it to the next smallest debt (while continuing to make minimum. There are tons of.

The Debt Snowball Method A Complete Guide With Free Printables Free

Make minimum payments on all your debts except the smallest debt. Dave ramsey rachel cruze ken coleman dr. The first page in the kit is.

Dave Ramsey Debt Snowball Spreadsheet And Dave Ramsey Snowball Sheet

Once your emergency fund is back to $1,000, restart your debt snowball. Here you will list all of your debts from smallest to. Next, it’s.

The Dave Ramsey Debt Snowball Simplified My Worthy Penny Dave

Web the debt snowball method is the best way to get out of debt. List all of your debts smallest to largest, and use this.

List All Of Your Debts Smallest To Largest, And Use This Sheet To Mark Them Off One By One.

Attack that one with everything you’ve got, using any extra money you have left after you’ve covered. Make minimum payments on all your debts except the smallest. There are tons of ways to pay off debt, but i would argue that this method is the most successful. Debt snowball this is the fun one!

Dave Ramsey Rachel Cruze Ken Coleman Dr.

Pay minimum payments on everything but the. List your debts from smallest to largest. Do i pause the debt snowball if i have to use my emergency fund? Make minimum payments on all debts except the smallest—throwing as much money as you can at that one.

Once That Debt Is Gone, Take Its Payment And Apply It To The Next Smallest Debt (While Continuing To Make Minimum.

This is the exact debt snowball form that we used to get out debt in that short period of time. Web the debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. Web here’s how the debt snowball method works: Web the fine print smart money happy hour.

Web The Debt Snowball Method Is The Best Way To Get Out Of Debt.

I have the perfect worksheet to help you with this step. Once your emergency fund is back to $1,000, restart your debt snowball. Make minimum payments on all your debts except the smallest debt. You should temporarily pause the debt snowball if you use your emergency fund.