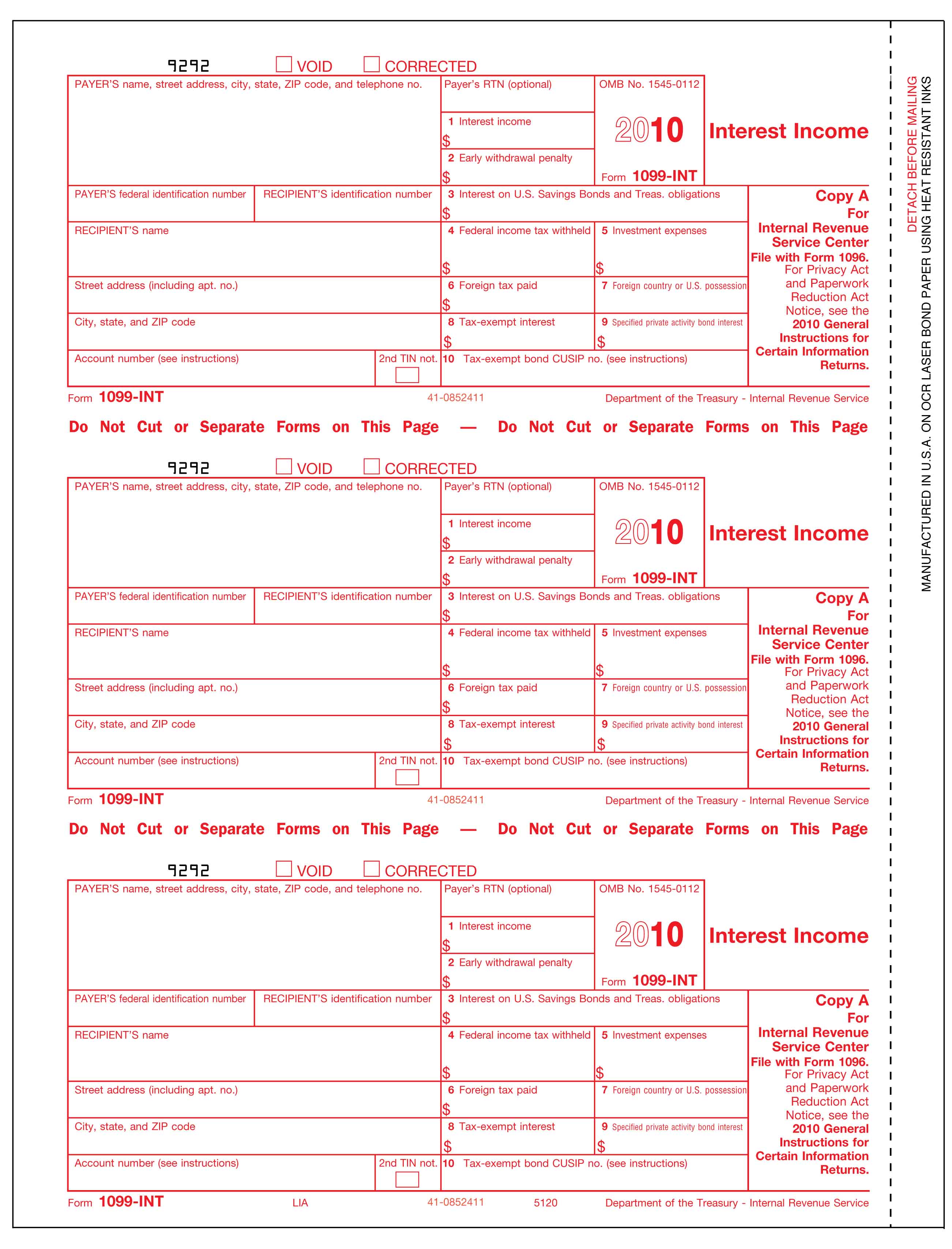

Free Printable 1099 Forms - You can print the following number of copies for these 1099 forms on 1 page: Web updated november 27, 2023. Web updated november 06, 2023. Persons with a hearing or speech disability with access to tty/tdd equipment can. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Web free trials & demos westlaw precision; Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Kansas city, missouri, or ogden, utah processing center. Get free support and guidance from our experts.

Irs 1099 Printable Form Printable Forms Free Online

Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages,.

Free Printable 1099 R Form Printable Templates

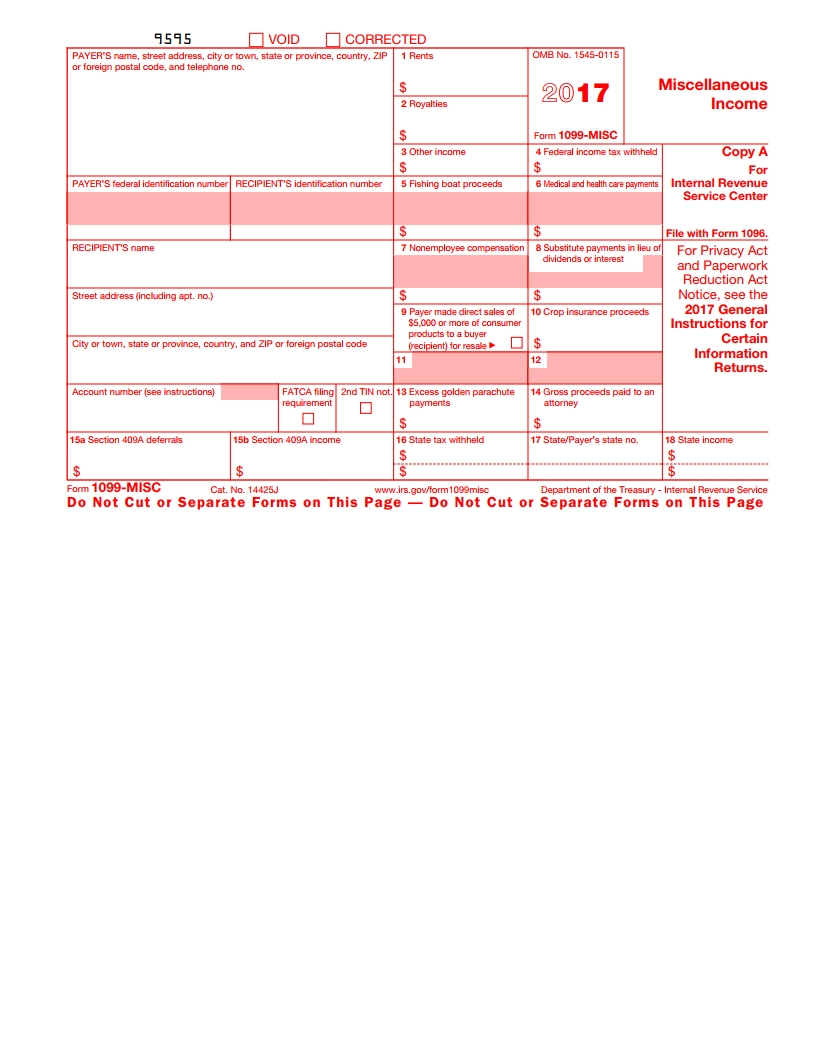

Persons with a hearing or speech disability with access to tty/tdd equipment can. Shows your total compensation of excess golden parachute payments subject to a.

Print Blank 1099 Form Printable Form, Templates and Letter

There are various types of 1099s, depending on the type of income in question. File your 1099 with the irs for free using freetaxusa. They.

1099 MISC Tax Basics 2021 Tax Forms 1040 Printable

Get free support and guidance from our experts. They are identical, the only difference is that you have to send copy a to the irs.

1099 Format, 1099 Forms, 1099 Tax Forms Print Forms

They are identical, the only difference is that you have to send copy a to the irs and copy b to the payee for their.

Printable 1099 Form Pdf Free Printable Download

Web updated november 27, 2023. See your tax return instructions for where to report. Shows your total compensation of excess golden parachute payments subject to.

1099 Nec Form Printable Printable Forms Free Online

These can include payments to independent contractors, gambling winnings, rents, royalties, and more. Web a 1099 form is a tax record that an entity or.

1099 Form Template. Create A Free 1099 Form Form.

The address you use depends on the location of your business and will either need to be sent to their austin, texas; Kansas city, missouri,.

Free Printable 1099 Misc Forms Free Printable

You may also have a filing requirement. You can print the following number of copies for these 1099 forms on 1 page: File your 1099.

The Due Date For Furnishing A Copy To Your Contractors And Vendors.

You may also have a filing requirement. There are various types of 1099s, depending on the type of income in question. Copy a and copy b. Web free trials & demos westlaw precision;

Web A 1099 Form Is A Tax Record That An Entity Or Person — Not Your Employer — Gave Or Paid You Money.

Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Web updated november 06, 2023. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Starting tax year 2023, if you have 10 or more information returns, you must file them electronically.

Prepare Form 1099 (All Variations) Printable 1099 Forms.

Kansas city, missouri, or ogden, utah processing center. Web 10 or more returns: 1099s fall into a group of tax documents. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form.

These Can Include Payments To Independent Contractors, Gambling Winnings, Rents, Royalties, And More.

Persons with a hearing or speech disability with access to tty/tdd equipment can. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Fill, generate & download or print copies for free. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax.