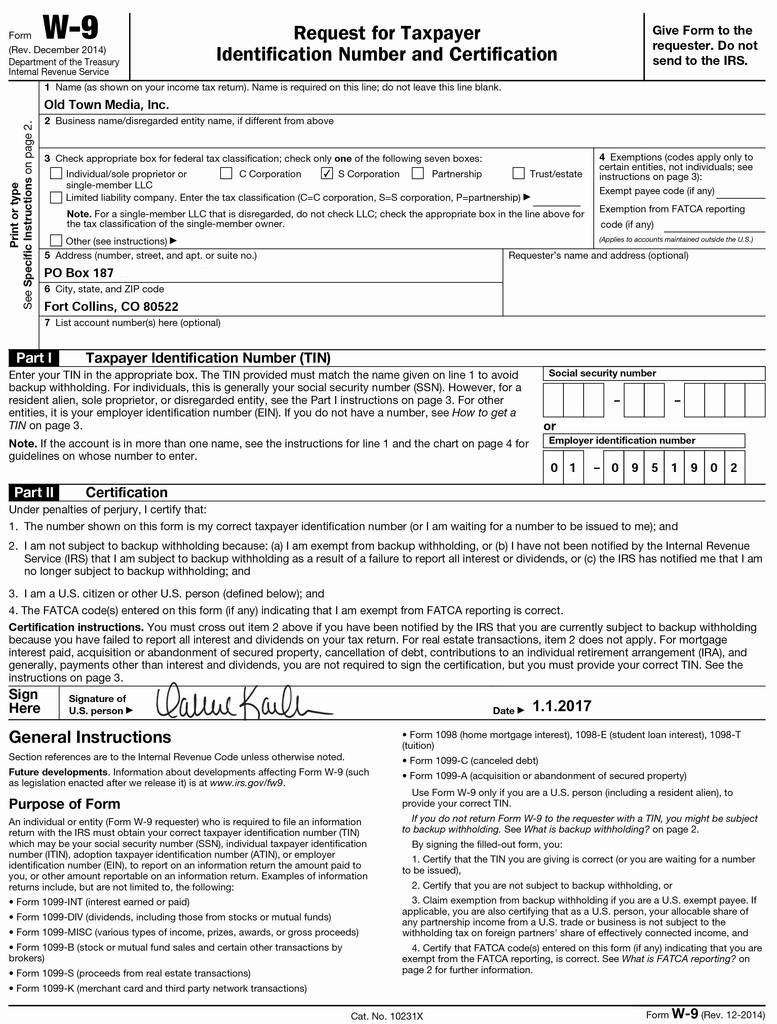

Irs Form 147C Printable - The 147c letters are documents sent by the irs to businesses. Use this form to —. Web the 147c letter, also known as an ein confirmation letter, is a document from the irs that verifies a company’s employer identification number (ein). The irs offers the following options: Web how do i get a form 147c from irs? Web a 147c letter is just the document you need if you’ve lost your employer identification number (ein). Additional information is available at irs.gov on qualifying residences. Request a copy of form 147c (confirmation of ein) from the irs representative. What is a cp 575 form? Edit your irs form 147c printable online.

147c Letter Printable 147c Form

Additional information is available at irs.gov on qualifying residences. Web irs letter 147c is an official form of verification issued by the irs (internal revenue.

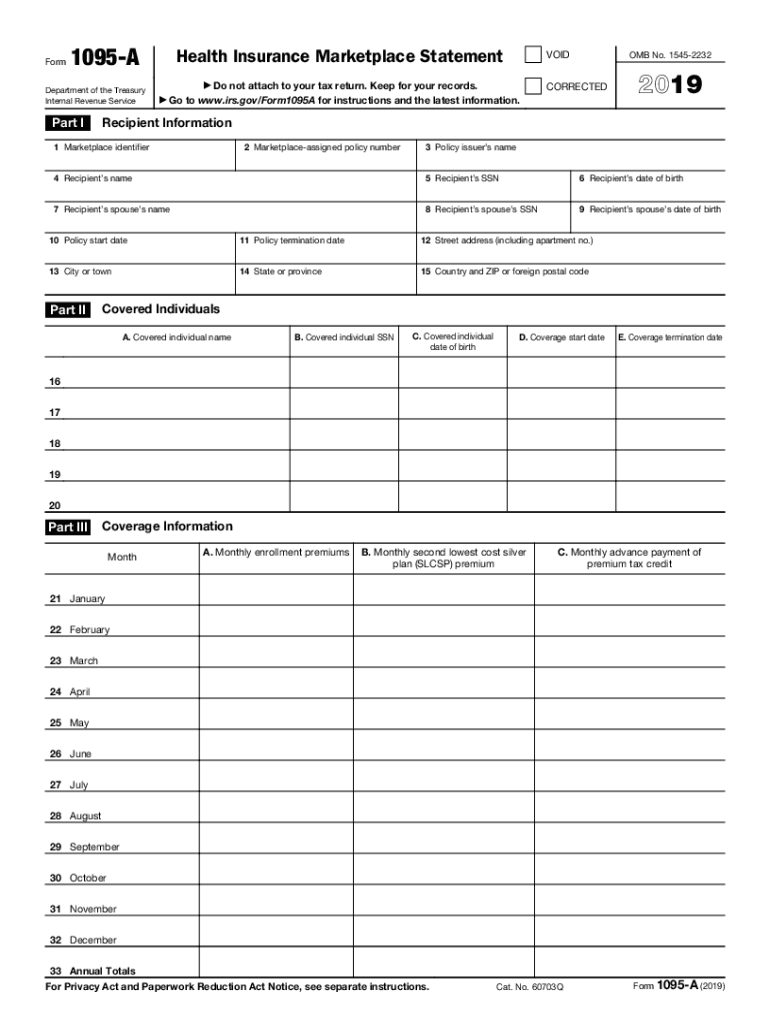

2019 Form IRS 1095A Fill Online, Printable, Fillable, Blank pdfFiller

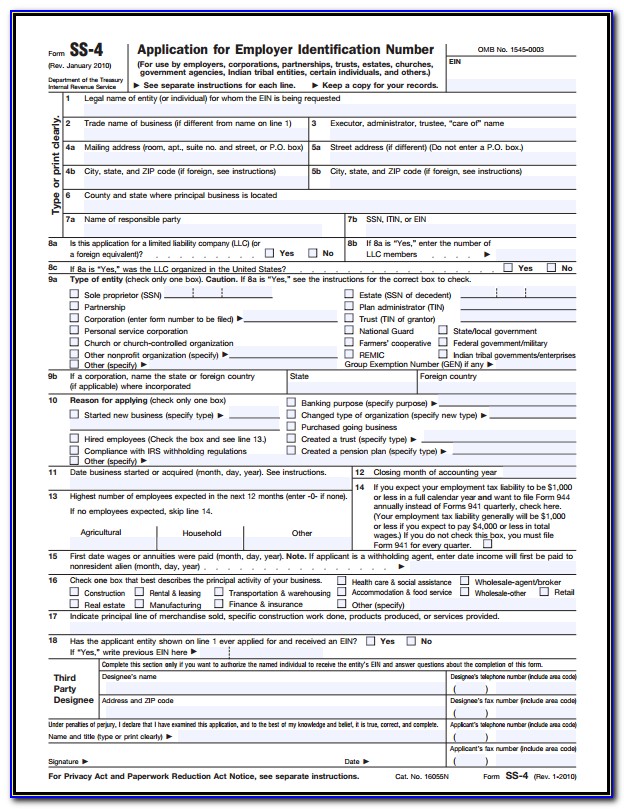

Web an fym is required for all entities that are liable for an income tax return (form 1120, form 1065, or form 1041). Web the.

Irs Form 147C Printable

Use this option if you speak english or spanish and can call the. Use this form to —. Sign it in a few clicks. You.

Irs Form 147C Printable

Web a 147c letter is just the document you need if you’ve lost your employer identification number (ein). Request a copy of form 147c (confirmation.

18 [pdf] 147C TAX IDENTIFICATION LETTER PRINTABLE DOCX ZIP DOWNLOAD

Type text, add images, blackout confidential details, add comments, highlights and more. Web learn what a 147c letter is, why you need it, and how.

Free Printable I 9 Forms Example Calendar Printable

Use the information in the table below to validate the fym. Additional information is available at irs.gov on qualifying residences. The company is sent a.

Irs Form 147C Printable

Web learn what a 147c letter is, why you need it, and how to get one from the irs. Web a 147c letter is just.

2020 Form IRS 1040X Fill Online, Printable, Fillable, Blank pdfFiller

Web find current and prior year forms, instructions and publications for federal tax purposes. Web if your clergy and/or employees are unable to e‐file their.

2021 IRS Form 5695 Fill Online, Printable, Fillable, Blank pdfFiller

Can i get a new cp 575 from the irs? Web a 147c letter is just the document you need if you’ve lost your employer.

Web What Is A 147C Letter?

You must also fill the form out a certain way (on line 7b) in order to have your ein approved. Web the 147c letter, also known as an ein confirmation letter, is a document from the irs that verifies a company’s employer identification number (ein). Web find current and prior year forms, instructions and publications for federal tax purposes. For security reasons, the irs will never send anything by email.

Learn What It Is Exactly, When You Need It, And How To.

Web taxpayers can carry forward excess unused credit and apply it to any tax owed in future years. Request a copy of form 147c (confirmation of ein) from the irs representative. Find out the steps, options, and tips for requesting and using form. Use this form to —.

How Did Irs Send Me The Cp 575 Form?

Use the information in the table below to validate the fym. Web a 147c letter is just the document you need if you’ve lost your employer identification number (ein). Web if your clergy and/or employees are unable to e‐file their income tax returns because of a problem with your fein ore ein (federal employer identification number), you can. Web the only way to ask the irs for a 147c letter is to call them.

Web A 147C Letter Is A Document From The Internal Revenue Service (Irs) That Officially Requests Confirmation Of Your Organization’s Employee Identification Number.

The company is sent a letter asking for information about its ein or. The 147c letters are documents sent by the irs to businesses. Web an fym is required for all entities that are liable for an income tax return (form 1120, form 1065, or form 1041). Sign it in a few clicks.