Printable 1040 Sr Form - Your first name and middle initial. With freya allan, kevin durand, dichen lachman, william h. Tax return for seniors, including recent updates, related forms and instructions on how to file. This includes items such as: Tax return for seniors” could make filing season a bit less taxing for some older taxpayers — provided you qualify to use it. You may be able to take this credit and reduce your tax if by the end of 2022: Web kingdom of the planet of the apes: Federal income tax forms and instructions are generally published in december of each year by the irs. Its creation was mandated by. Filing single married filing jointly.

Irs 1040 Form / Best Use for 1040SR Tax Form for Seniors Irs form

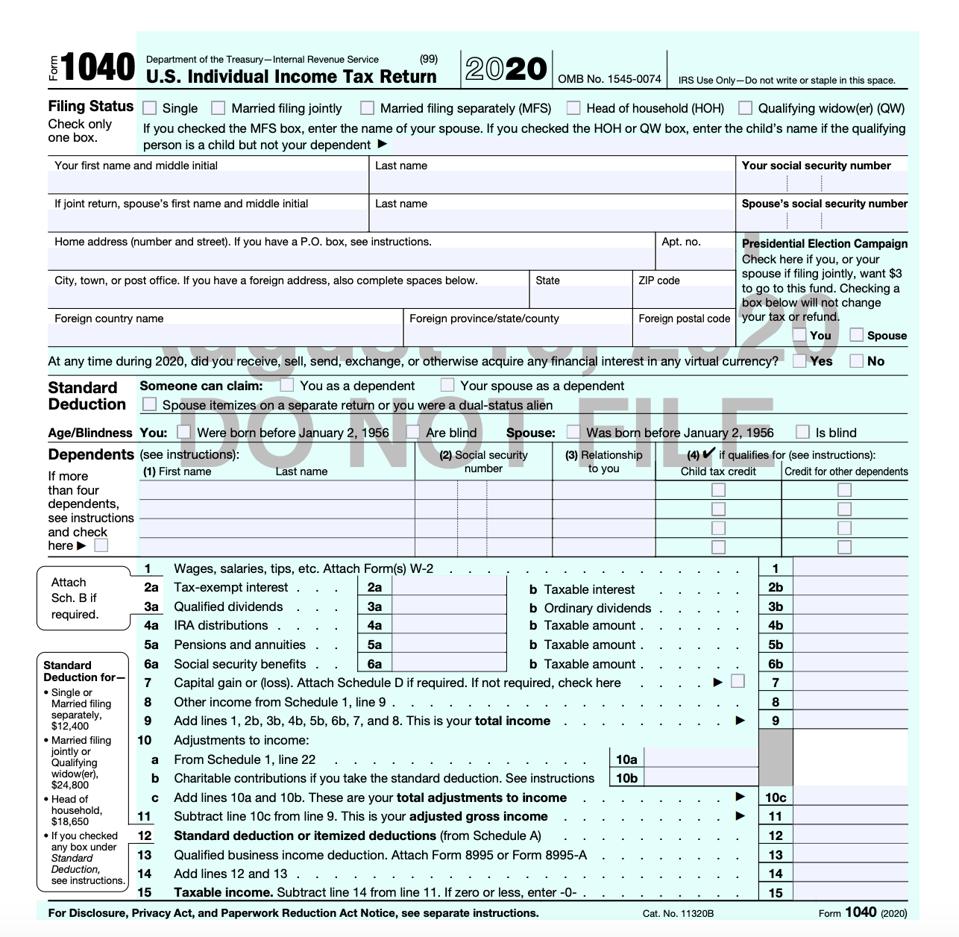

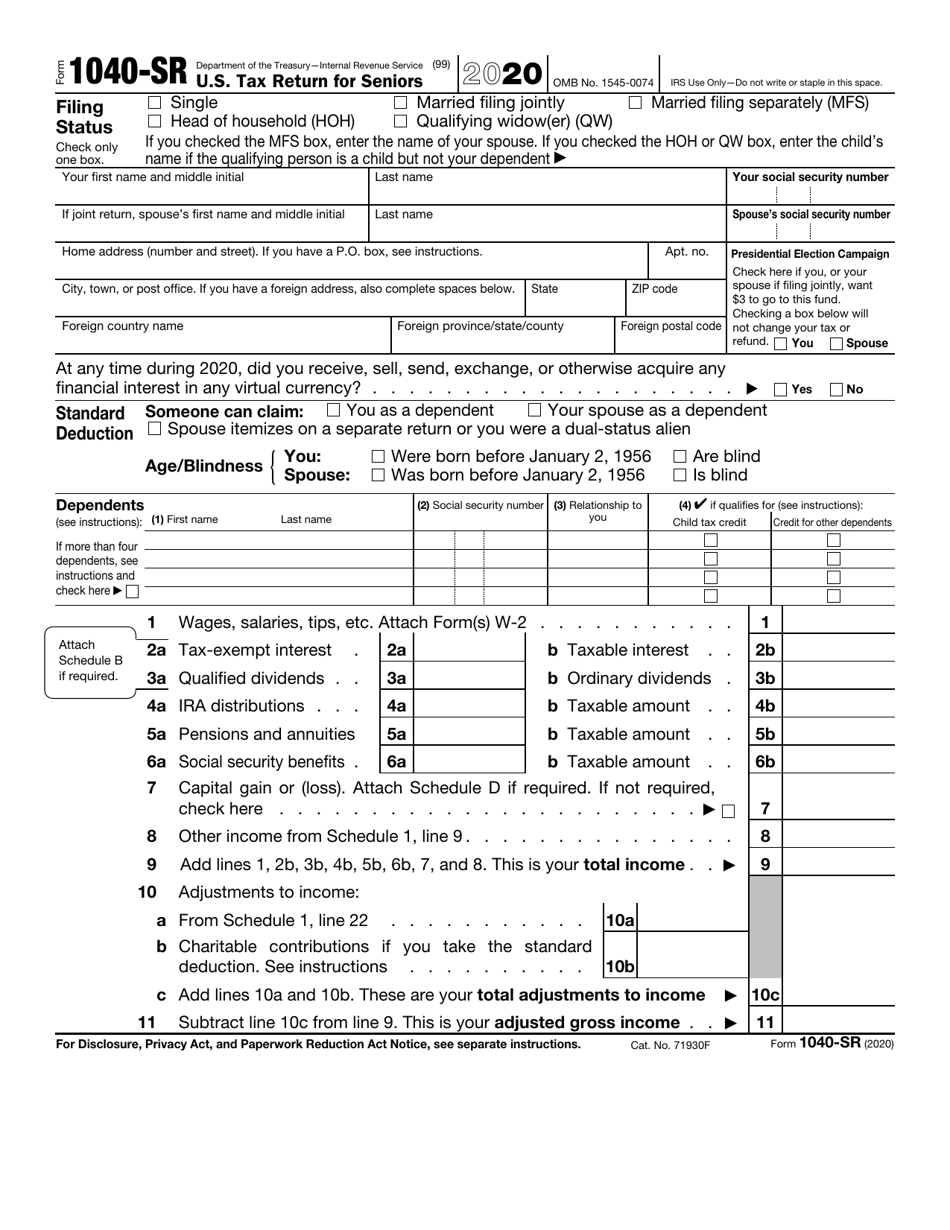

Tax return for seniors department of the treasury—internal revenue service (99) 2020 omb no. Web the tax cuts and jobs act, signed into law in.

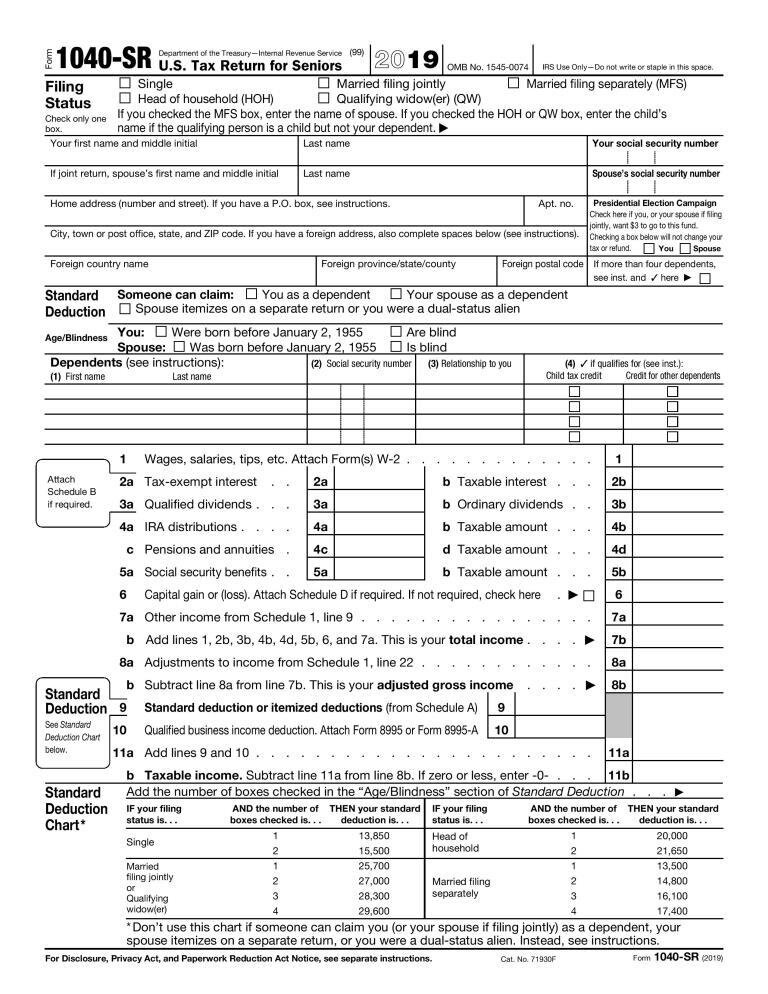

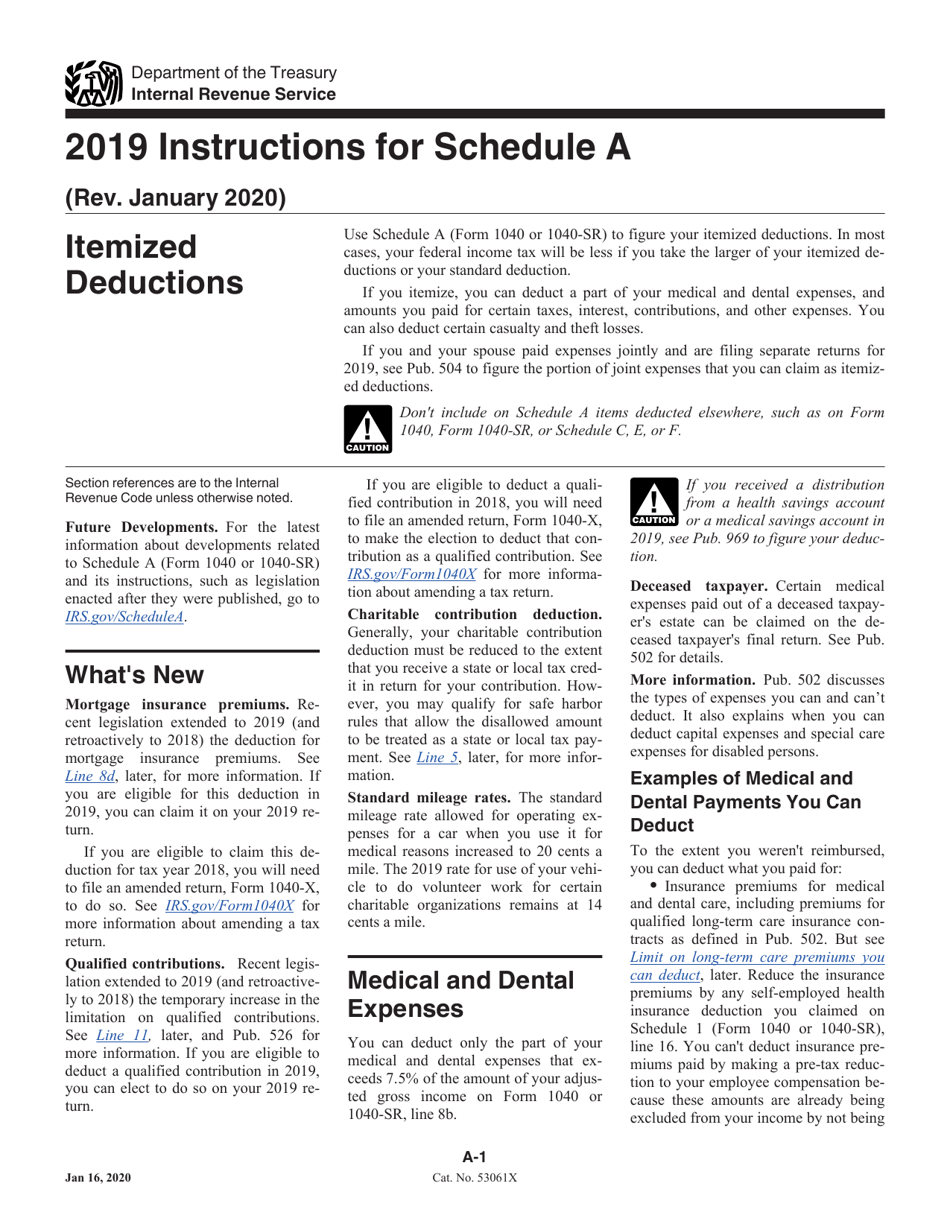

The New 2019 Form 1040 SR U S Tax Return For Seniors 1040 Form Printable

Assume the dependent is not eligible for the child dependent care credit or the other dependent credit. Web calculating your tax liability. Tax return for.

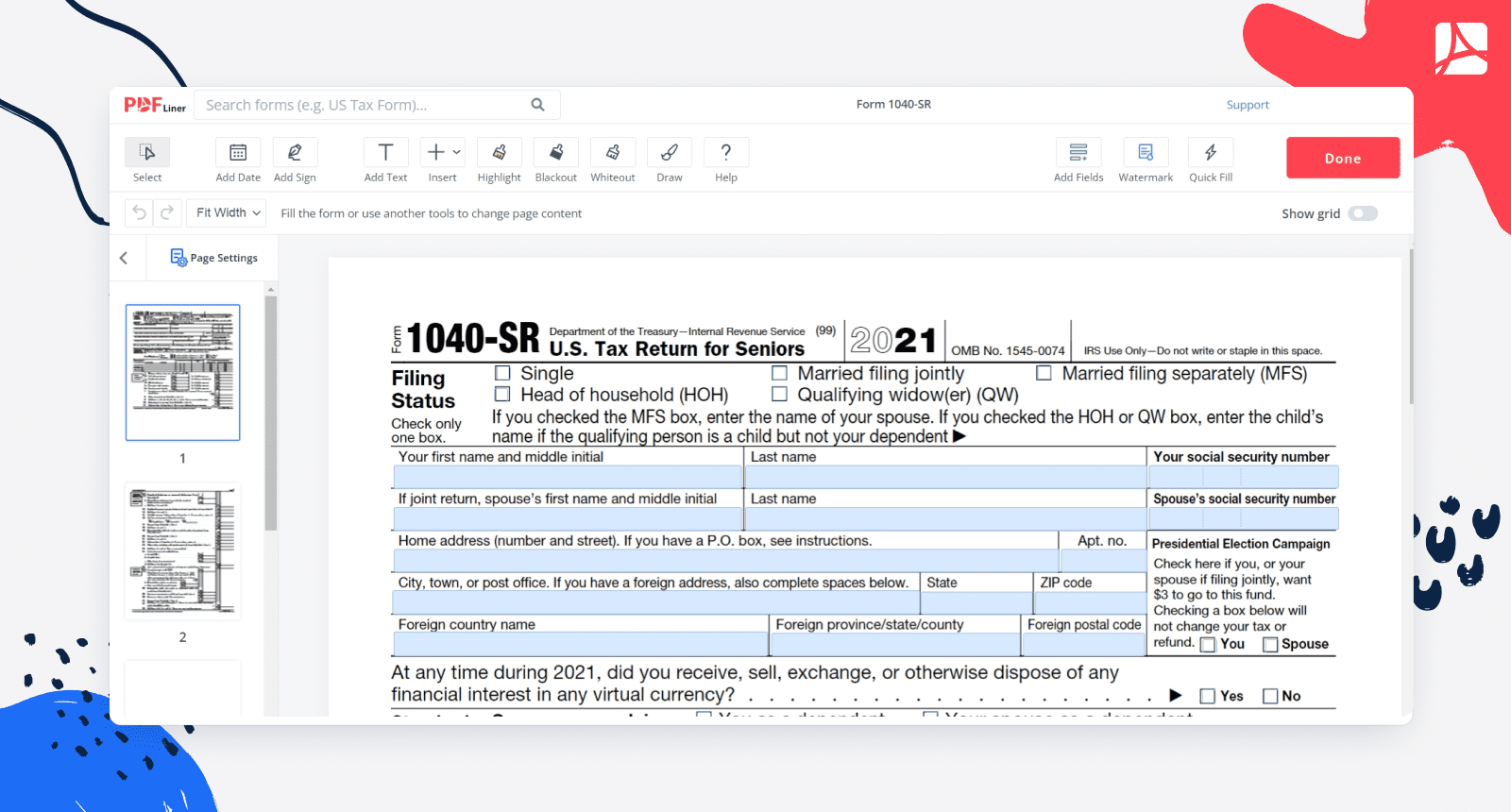

Form 1040SR (2022) Sign Online, Print Form PDFliner

If you are at least 65 years old or blind, you can claim an added 2023 standard deduction of $1,500 if your filing status is.

Irs 1040 Form / Best Use for 1040SR Tax Form for Seniors Irs form

Tax return for seniors department of the treasury—internal revenue service (99) 2020 omb no. Irs use only—do not write or staple in this space. Seniors.

IRS Form 1040SR Download Fillable PDF or Fill Online U.S. Tax Return

Keep in mind, these are draft samples only and not to be filed. You may be able to take this credit and reduce your tax.

How to Fill Out Form 1040SR Expert Guide

Irs use only—do not write or staple in this space. Irs use only—do not write or staple in this space. Department of the treasury—internal revenue.

Irs Fillable Form 1040 Irs Schedule 1 Form 1040 Or 1040 Sr Fill Out

If you or your spouse were born before jan. Use schedule d to report sales, exchanges or some involuntary conversions of capital assets, certain capital.

Download Instructions for IRS Form 1040, 1040SR Schedule A Itemized

C tip income not reported on line 1a (see instructions). Web irs publication 554: • you were age 65 or older or • you were.

2023 Form 1040sr Printable Forms Free Online

If you’re married and filing jointly , only one spouse is required to meet the age limit. To file form 1040sr, senior taxpayers must be.

Irs Use Only—Do Not Write Or Staple In This Space.

If you checked the mfs box, enter the name of your spouse. Web the tax cuts and jobs act, signed into law in december 2017, consolidated the 1040, 1040a and 1040ez into a single and redesigned form 1040. Filing single married filing jointly. Tax return for seniors” could make filing season a bit less taxing for some older taxpayers — provided you qualify to use it.

Web Irs Publication 554:

Web taxpayer qualification requirements. You get an added $1,850 if using the single or head of household filing status. Individual income tax return form 1040 for fiscal year 2021. You don't have to be retired to.

Tax Return For Seniors, Including Recent Updates, Related Forms And Instructions On How To File.

Department of the treasury—internal revenue service. Web the internal revenue service's new “u.s. If you or your spouse were born before jan. Test scenario 1 includes the following forms:

This Year, That Means You Must Have Been Born Before January 2, 1957.

To file form 1040sr, senior taxpayers must be 65 or older as of the first of the year. If you are at least 65 years old or blind, you can claim an added 2023 standard deduction of $1,500 if your filing status is married filing jointly, married filing separately or qualifying surviving spouse filing status. Irs use only—do not write or staple in this space. Web calculating your tax liability.

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-f619eccef6a84e3ab500003fcc088ce8.png)