Printable 1099 Forms For Independent Contractors - Fill out a 1099 form. Web irs 1099 form. Web discover the essentials of paying independent contractors with our guide. How contractors use form 1099. Bbb a+ rated businesspaperless workflowtrusted by millionsover 100k legal forms Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income. Web what is an independent contractor 1099 form? Web what is a 1099 independent contractor? This form can be used to request the correct name and taxpayer identification number, or tin, of.

1099 Form

Learn about payment methods, contracts, tax obligations, and best practices. Web the contractor portal is a free feature for both accounting software and payroll software.

How To File A 1099 Form Independent Contractor Universal Network

This form can be used to request the correct name and taxpayer identification number, or tin, of. How to file a 1099 form online. Starting.

Printable 1099 Form Pdf Free Printable Download

Web a 1099 employee can also be called a freelancer, independent contractor, or contract worker. Starting tax year 2023, if you have 10 or more.

Free Independent Contractor Agreement Template 1099 Word PDF eForms

Money back guaranteefast, easy & securetrusted by millionsfree mobile app Web irs 1099 form. Web discover the essentials of paying independent contractors with our guide..

Printable Independent Contractor 1099 Form Printable Forms Free Online

Web what is a 1099 independent contractor? A person who contracts to perform services for others without having the legal status of an employee is.

Printable 1099 Form Independent Contractor Master of

Learn about payment methods, contracts, tax obligations, and best practices. Web isaiah mccoy, cpa. How contractors use form 1099. Money back guaranteefast, easy & securetrusted.

What Irs Form For Independent Contractor

With quickbooks online simple start, you can create and submit 1099 forms. This form can be used to request the correct name and taxpayer identification.

Free Independent Contractor Agreement Template 1099 Word PDF eForms

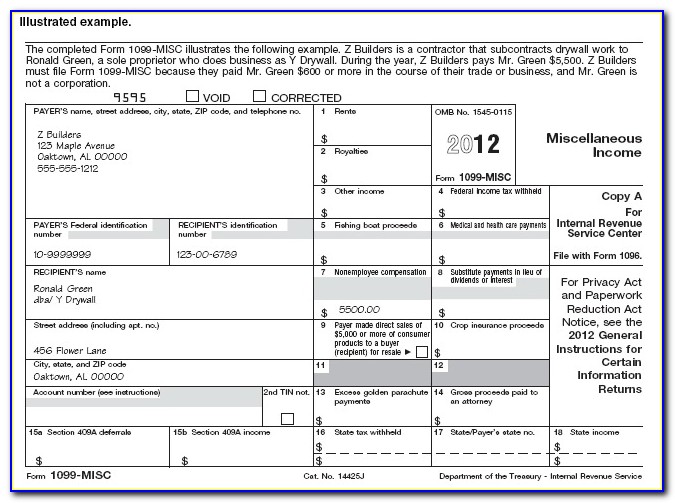

This reports payments a company makes of $600 or more to a non. Fill out a 1099 form. How contractors use form 1099. Web isaiah.

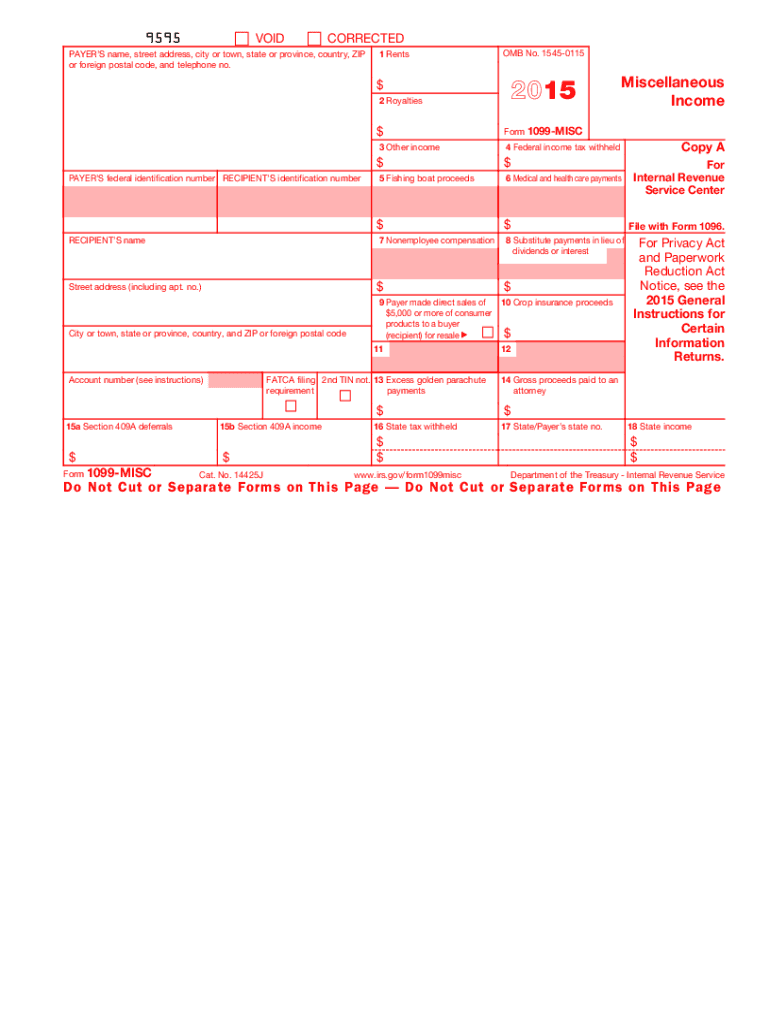

2015 form 1099 Fill out & sign online DocHub

Web what is a 1099 independent contractor? Web the contractor portal is a free feature for both accounting software and payroll software customers who pay.

Web Irs 1099 Form.

This form can be used to request the correct name and taxpayer identification number, or tin, of. Bbb a+ rated businesspaperless workflowtrusted by millionsover 100k legal forms Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. How contractors use form 1099.

Web Yes, You Can Issue 1099 Forms With Quickbooks Online Simple Start Plan, Andres.

Money back guaranteefast, easy & securetrusted by millionsfree mobile app Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income. Web isaiah mccoy, cpa. Web what is an independent contractor 1099 form?

Web The Contractor Portal Is A Free Feature For Both Accounting Software And Payroll Software Customers Who Pay 1099 Independent Contractors.

How to file a 1099 form online. With quickbooks online simple start, you can create and submit 1099 forms. Fill out a 1099 form. Web discover the essentials of paying independent contractors with our guide.

Web What Is A 1099 Independent Contractor?

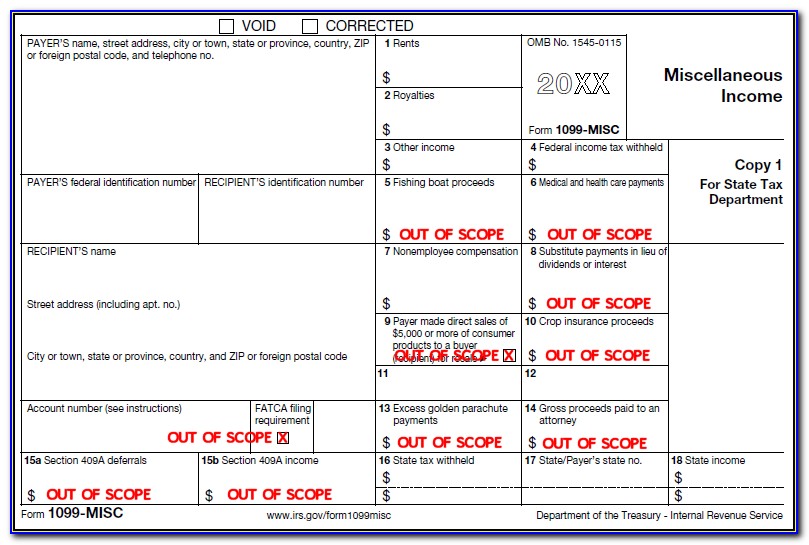

This reports payments a company makes of $600 or more to a non. Web to ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and. Learn about payment methods, contracts, tax obligations, and best practices. Web 10 or more returns: