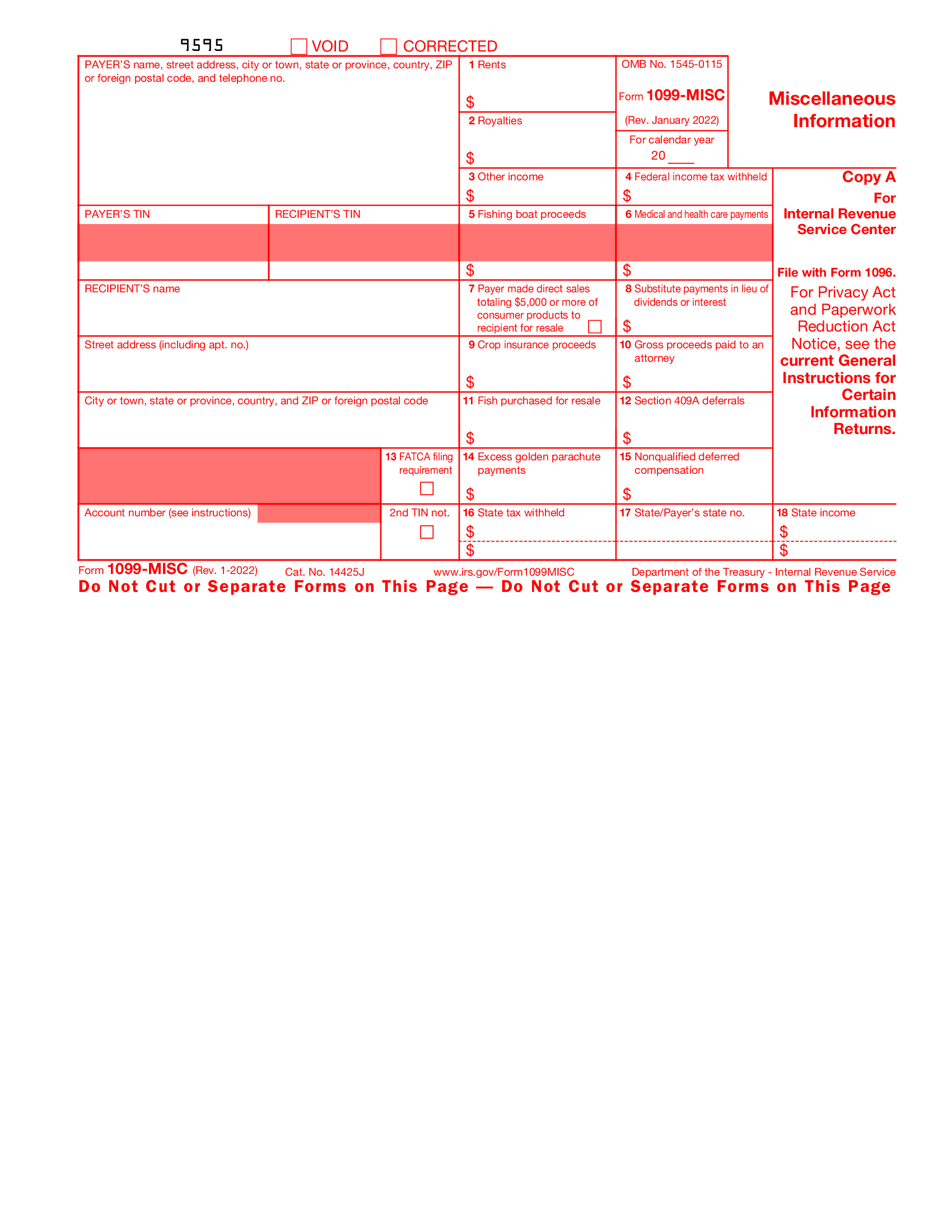

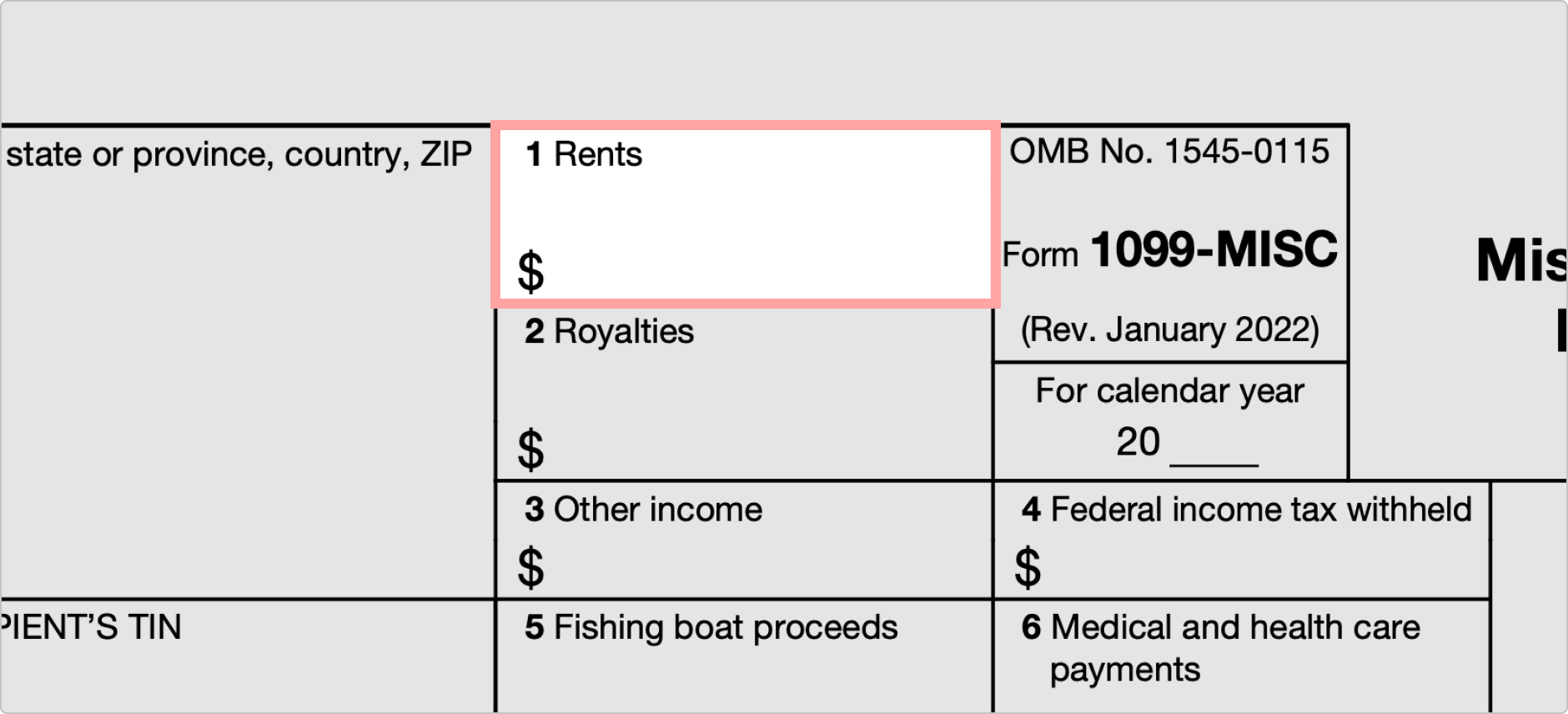

Printable 1099 Misc Form - Web form 1099 is a collection of forms used to report payments that typically aren't from an employer. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Prepare form 1099 (all variations). If you work as an independent contractor or freelancer, you'll likely have income. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. To the irs by february 28, 2024 if filing by mail. Click “print 1099” or “print 1096” if you only want that form. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. [7] how to file (5 steps). Also remember that if the payee is a registered c or s corporation, you don’t have to file a.

Fillable 1099 Misc Irs 2023 Fillable Form 2023

These can include payments to independent contractors, gambling winnings, rents, royalties, and more. Web rental income can be a lucrative venture for many individuals, but.

Fillable 1099 Misc Irs 2022 Fillable Form 2024

Web form 1099 is a collection of forms used to report payments that typically aren't from an employer. To the irs by february 28, 2024.

Form 1099MISC for independent consultants (6 step guide)

Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. Select each.

1099MISC Form Fillable, Printable, Download. 2023 Instructions

Examples of amounts included in this box are deceased employee’s wages paid to an estate or beneficiary, prizes and awards, damages and juror’s compensation. Also.

1099MISC Form Template Create and Fill Online

Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Web 10 or more returns: Also remember that.

How to Fill Out and Print 1099 MISC Forms

To the irs by february 28, 2024 if filing by mail. To recipients by january 31, 2024. Select each contractor you want to print 1099s.

What is a 1099Misc Form? Financial Strategy Center

Any other payments exceeding $600,. Examples of amounts included in this box are deceased employee’s wages paid to an estate or beneficiary, prizes and awards,.

Tax Form 1099MISC Instructions How to Fill It Out Tipalti

Fill, generate & download or print copies for free. Starting tax year 2023, if you have 10 or more information returns, you must file them.

1099MISC Form Fillable, Printable, Download Free. 2021 Instructions

Web recipient’s taxpayer identification number (tin). You should issue all other payments to the recipient by. Payments above a specified dollar threshold for rents, royalties,.

To Recipients By January 31, 2024.

Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. “it’s an aggregate of all the information returns filed under an employer identification number. To the irs by february 28, 2024 if filing by mail. Also remember that if the payee is a registered c or s corporation, you don’t have to file a.

Select Each Contractor You Want To Print 1099S For.

If they don’t meet the $600 threshold, you don’t have to file. Attorney fees for professional services of any amount. Prepare form 1099 (all variations). Fill, generate & download or print copies for free.

Examples Of Amounts Included In This Box Are Deceased Employee’s Wages Paid To An Estate Or Beneficiary, Prizes And Awards, Damages And Juror’s Compensation.

Click “print 1099” or “print 1096” if you only want that form. Beholden to their own tax reporting requirements and file their own tax returns without the need for a 1099. Web 10 or more returns: Web form 1099 is a collection of forms used to report payments that typically aren't from an employer.

You Should Issue All Other Payments To The Recipient By.

Persons with a hearing or speech disability with access to tty/tdd equipment can. If you work as an independent contractor or freelancer, you'll likely have income. Income from box 3 is generally reported on line 21 of page 1 of your form 1040. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money.