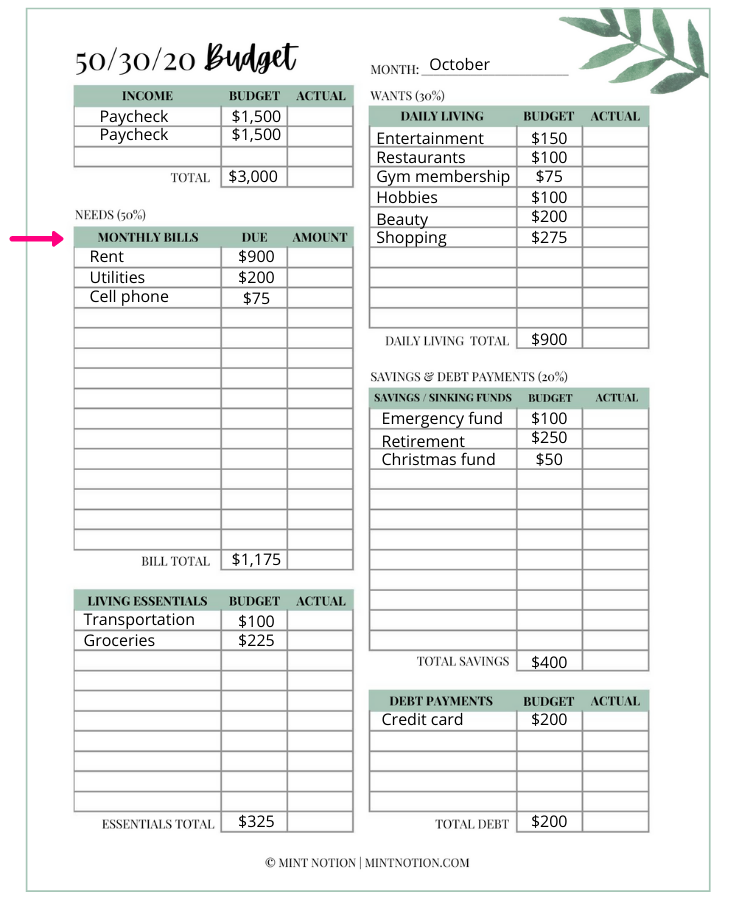

Printable 50 30 20 Rule - Just fill out all your income, needs, wants, and savings to see what your percentages are. Web that’s $2,400 total per month. The 50/30/20 budget is a good. Twenty percent goes toward a savings account or into investing. Amount for needs:0.5 × $5 000 = $2 500. Pretty & practical 50/30/20 budget printable. Savings on track and on target. Check out these cute printable 50/30/20 budget templates. Using a 50/30/20 budget calculator can make your budgeting efforts easier and save you tons of time. Jack’s monthly income:$60 000 ÷ 12 = $5 000.

Understanding the 50/30/20 Rule to Help You Save MagnifyMoney

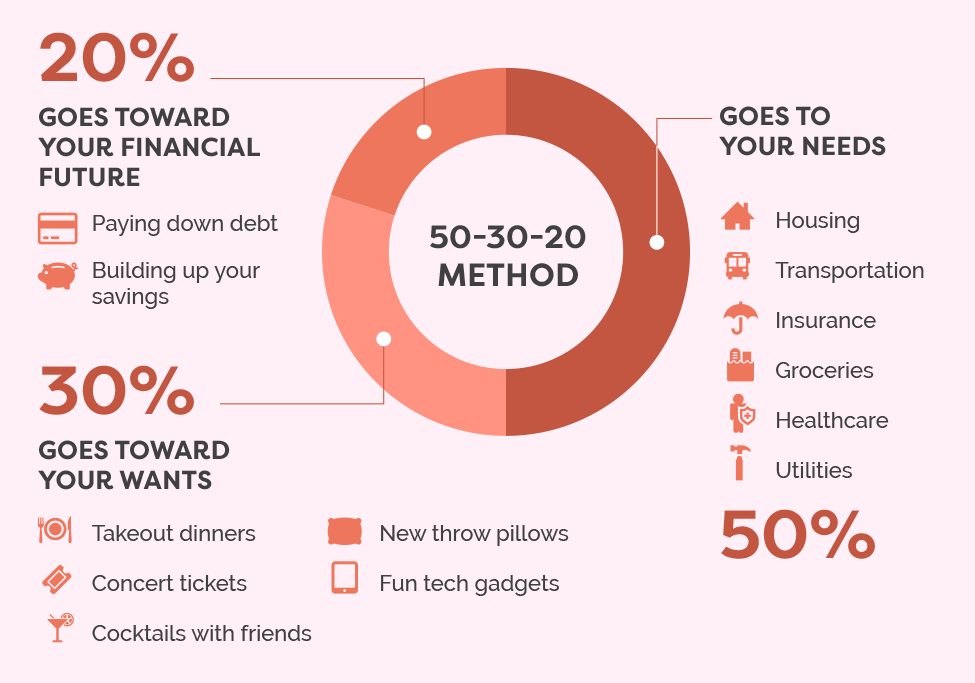

Web one of the reasons the 50/30/20 budget is popular is because it allows for 30% of a consumer’s income to go toward discretionary spending..

What is the 50/30/20 Budget Rule and How it Works Mint Notion

Unfortunately, that doesn’t leave as much room for savings and paying off debt. In fact, 46% of americans could not cover an unexpected expense of.

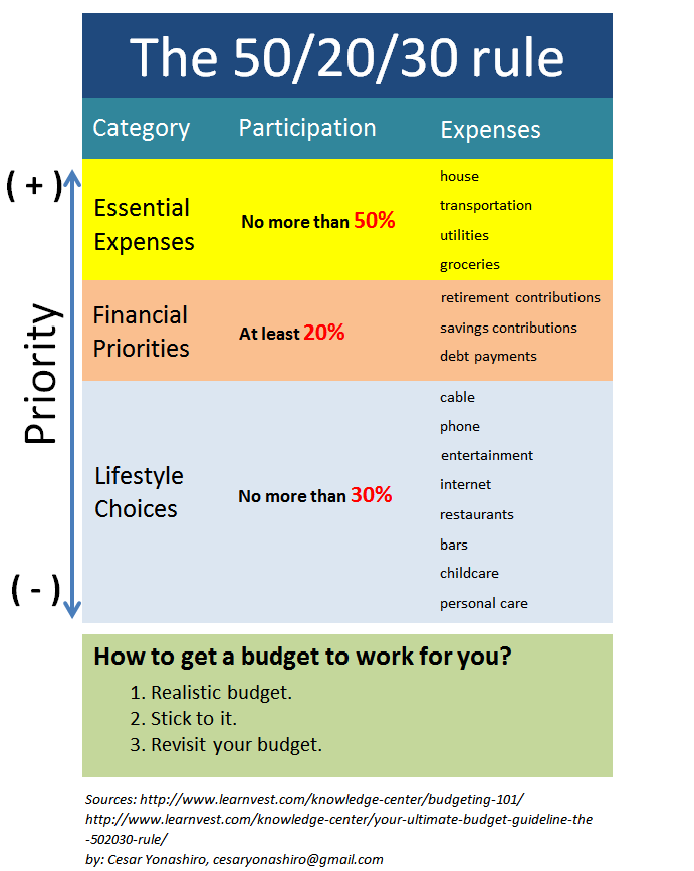

Economy and Finance Box How to budget your money. The 50/20/30 rule

50/30/20 budget planner in pastel colors. Amount for needs:0.5 × $5 000 = $2 500. $4,000 x 50% = $2,000 for needs. Designate 50% of.

How to Get Better at Budgeting — College Money Habits

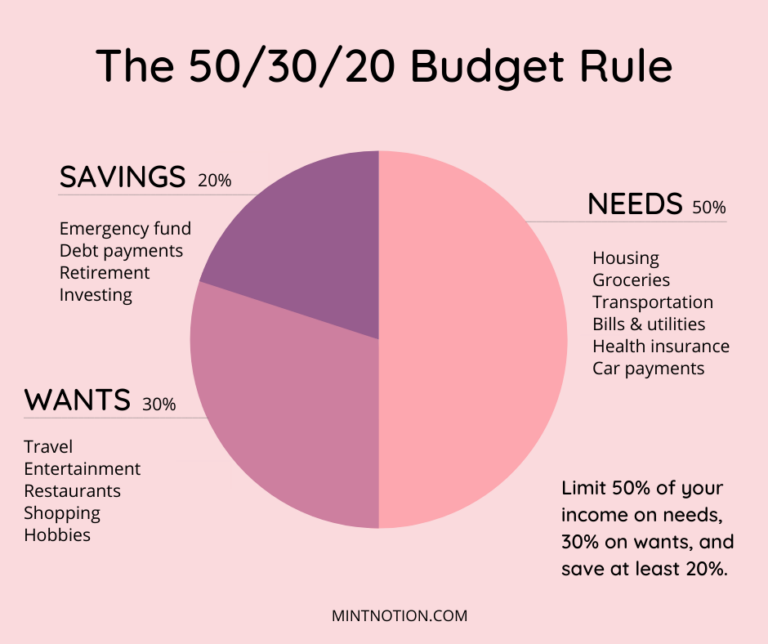

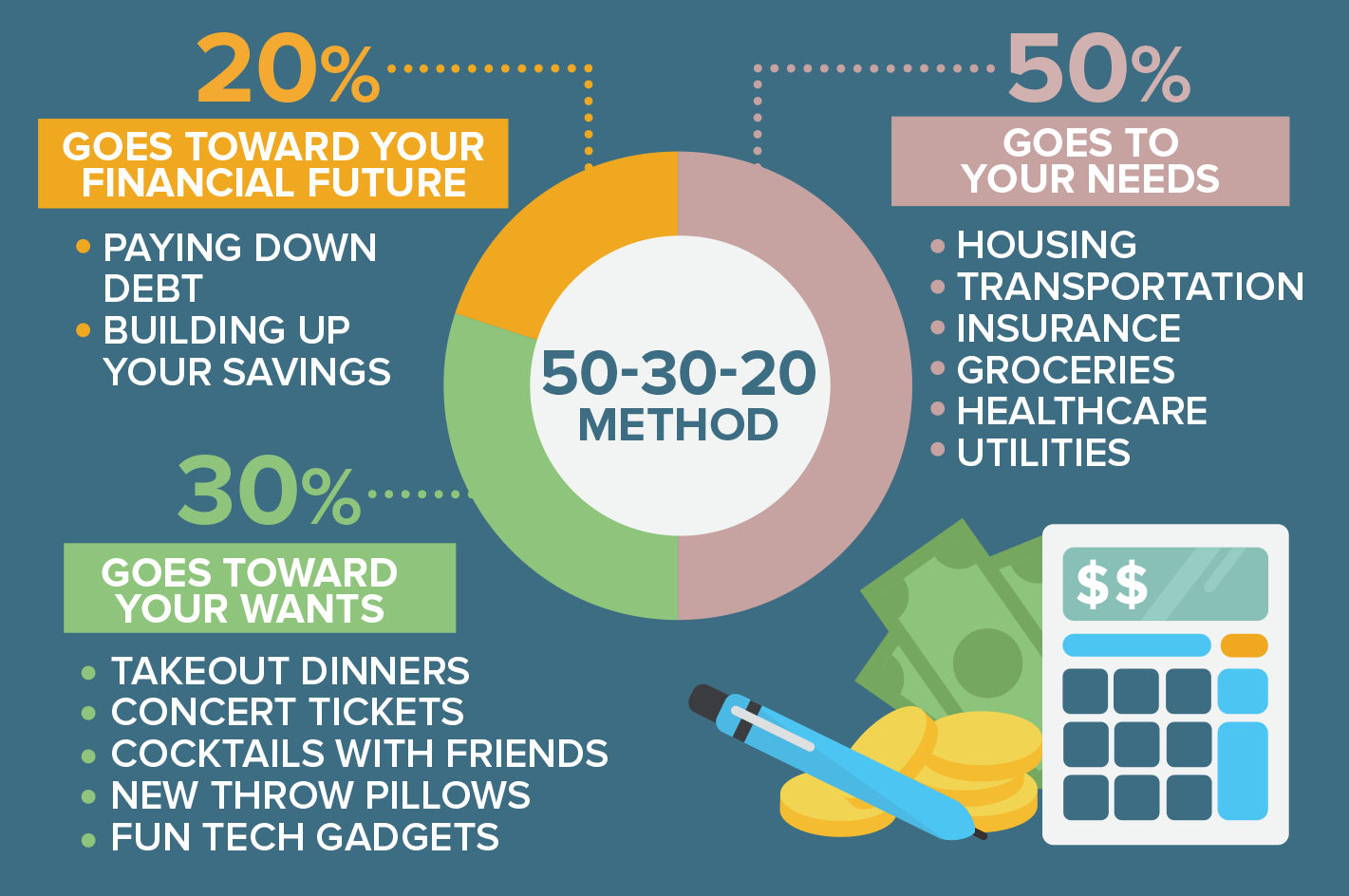

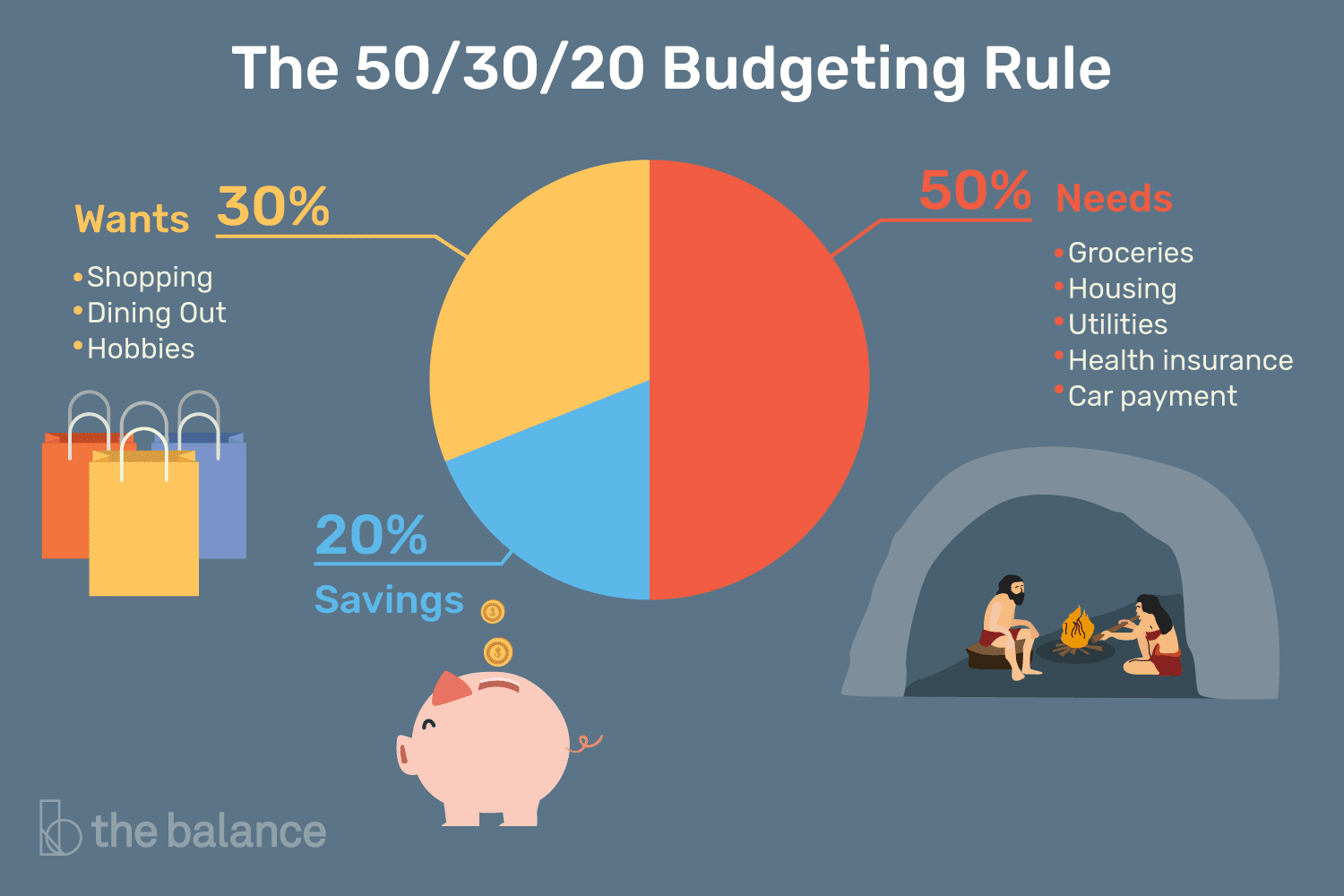

Web the 50/30/20 budgeting rule divides your budget into 3 main categories: To try this budgeting method out and get your free printable 50/30/20 budget.

503020 Budget Rule How to Make a Realistic Budget Mint Notion

Unfortunately, that doesn’t leave as much room for savings and paying off debt. Split your income between the 3 categories. Just fill out all your.

The 50/30/20 Rule Detterbeck Wealth Management

In fact, 46% of americans could not cover an unexpected expense of $400 and 31% do not have any retirement or pension. Our spreadsheet is.

The 50/30/20 Rule for Saving Money Saving money budget, Money

Here’s what her budget is going to look like: Just fill out all your income, needs, wants, and savings to see what your percentages are..

Enjoy Budgeting With the 503020 Rule Investdale

50% for needs, 30% for wants, and 20% for debt/savings. 50% to needs, 30% to wants and. The recommended percentages are as follows: Just fill.

How the 50/30/20 Rule Can Catapult Your Budget to Success helpmeimpoor

Amount for wants:0.3 × $5 000 = $1 500. $4,000 x 20% = $800 for savings / debt payoff. Web 50/30/20 budget spreadsheet: Web this.

Our Spreadsheet Is A Great Tool For Keeping Your Finances On Track.

Needs are all your monthly expenses that are essential and must be paid, such as rent. Amount for needs:0.5 × $5 000 = $2 500. Savings on track and on target. Web that’s $2,400 total per month.

By Far The Easiest Way To Implement The 50/30/20 Budgeting Rule Is To Use A Spreadsheet That Is Set Up To Manage Your Budget In This Way.

A plan like this helps simplify finances and is also easy to follow. 50% for needs, 30% for wants, and 20% for debt/savings. 50% to needs, 30% to wants and. Pretty & practical 50/30/20 budget printable.

Jack’s Monthly Income:$60 000 ÷ 12 = $5 000.

Check out these cute printable 50/30/20 budget templates. Unfortunately, that doesn’t leave as much room for savings and paying off debt. If 50% does not cover your living expenses, which is unfortunately the case for many people, then you can take some from your “wants” money, or even your savings, if necessary. $74,580 is the median household annual income.

50% Of Net Pay For Needs, 30% For Wants And 20% For Savings And Debt Repayment.

Just fill out all your income, needs, wants, and savings to see what your percentages are. 50% of $2,400 is $1,200. The 50/30/20 budget is a good. Twenty percent goes toward a savings account or into investing.