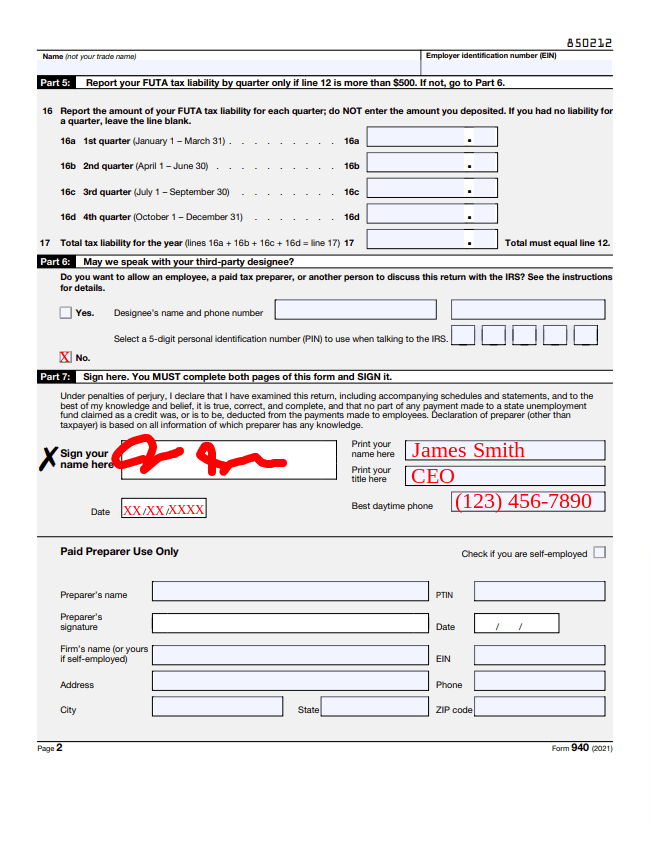

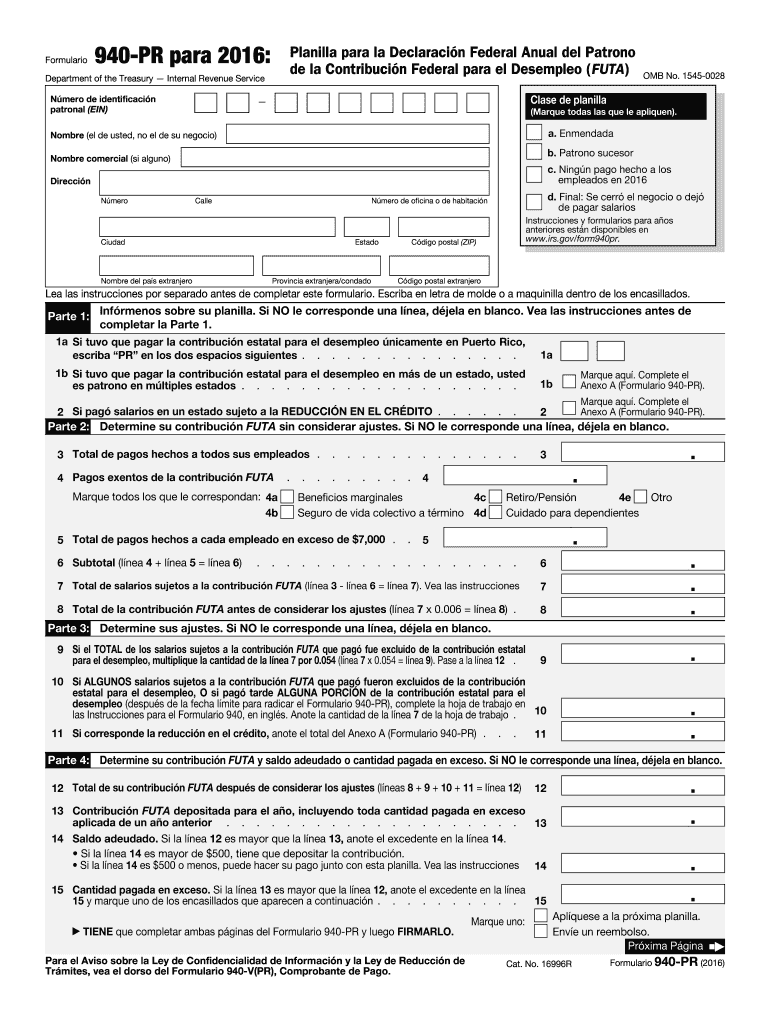

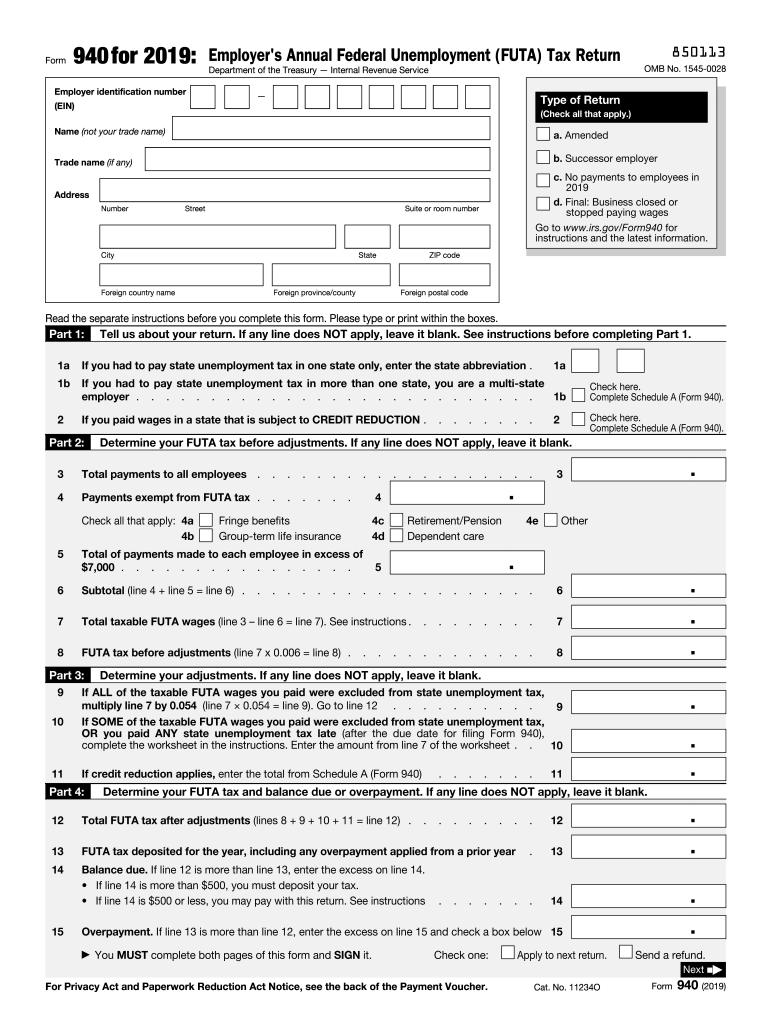

Printable Form 940 - Web employers in california and new york will have higher payroll costs for 2023 as the new futa tax credit rate is reduced by 0.6%, lowering it from 5.4% to 4.8%. It indicates a way to close an. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have lost their jobs. Web form 940 covers a standard calendar year, and the form and payment are due annually by january 31 for the prior year. If you are not a paid preparer, leave this section blank. Part 7 also includes a section for paid preparers to complete. Click the 940 (employer's annual federal unemployment tax return) link. 31 each year for the previous year. Web form 940 vs. Web futa filing dates.

940 Pr Form Fill Out and Sign Printable PDF Template airSlate SignNow

Web use form 940 to report your annual federal unemployment tax act (futa) tax. Take a look at a form 940 example. Web if you.

Irs Form 940 TAX

This means that the effective futa tax rate is 0.12% (up 0.6% from the standard rate of 0.6%). Web employers in california and new york.

Fillable Form 940 For 2023 Fillable Form 2024

If your amount of futa tax exceeds $500 for the calendar year, you have to make at least one quarterly payment. Web form 940 is.

Form 940 2019 Fill out & sign online DocHub

Futa taxes are regulated on a federal basis while suta taxes are governed by each state. Web form 940 vs. Web futa filing dates. Total.

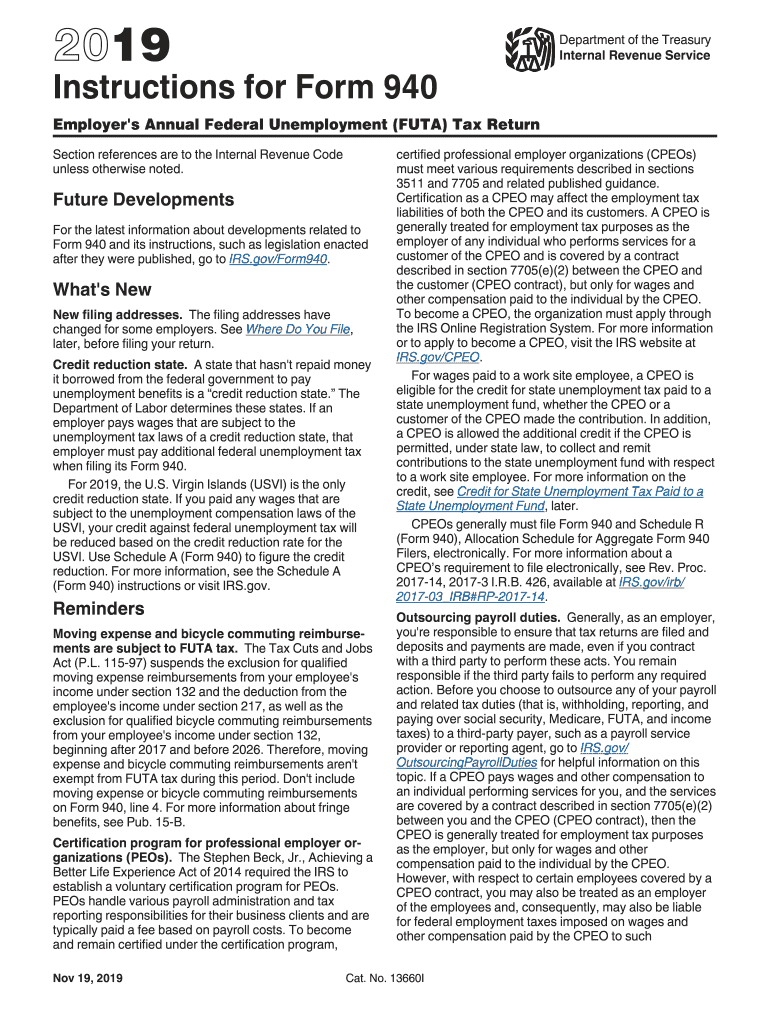

940 Instructions 2019 Form Fill Out and Sign Printable PDF Template

Here is the list of protentional participants and their early odds to win. Web irs form 940 reports an employer’s unemployment tax payments and calculations.

940 Form 2022 Fillable Online And Printable Fillable Form 2024

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 940,” and “2023” on your.

Irs Form 940 2021 Instructions loadedwith.buzz

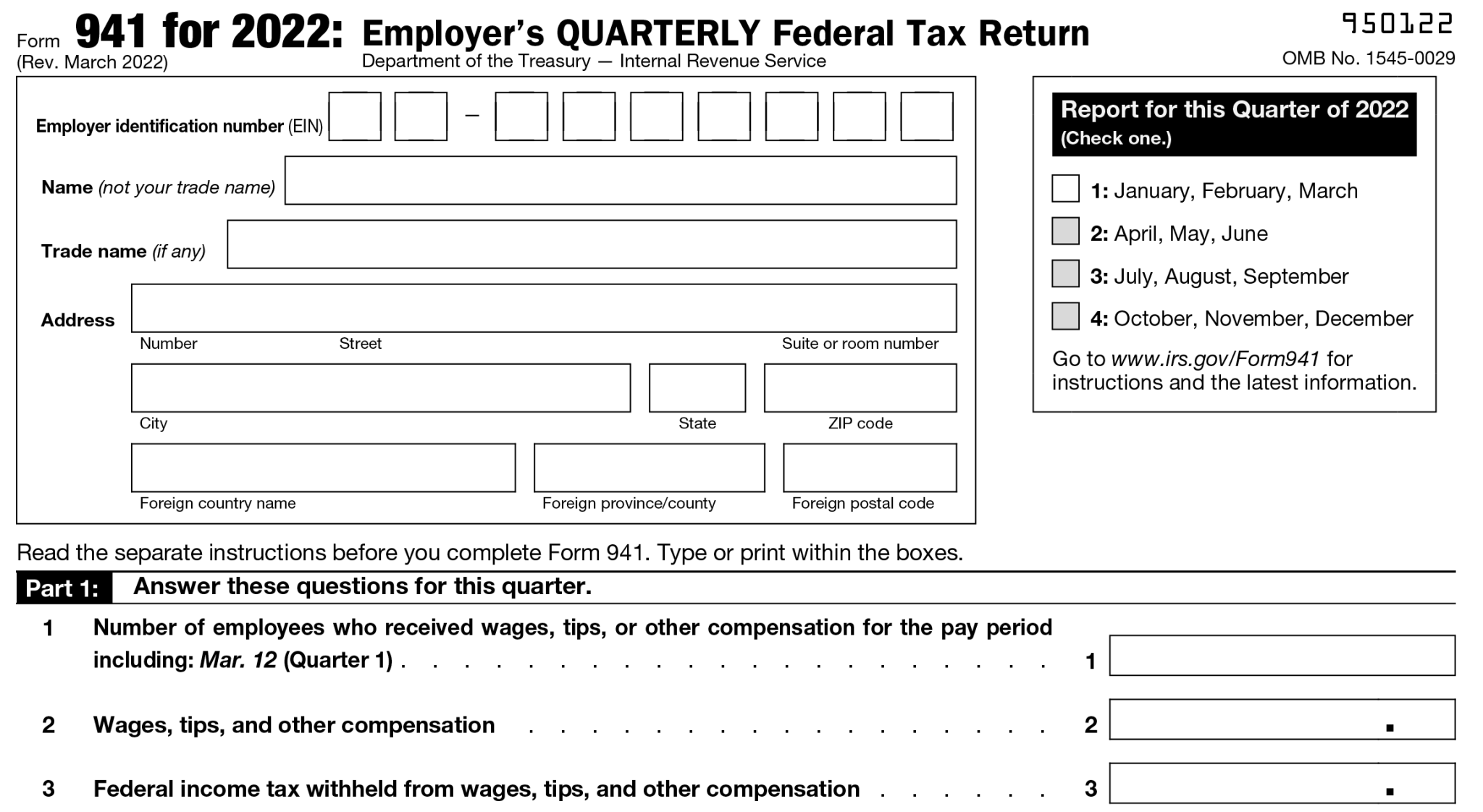

Employers use form 940 to report and pay their futa tax liability, while they use form 941 to pay their quarterly federal payroll taxes. Certain.

What Is IRS Form 940?

Web making payments with form 940 to avoid a penalty, make your payment with your 2023 form 940 only if your futa tax for the.

How to Fill Out Form 940 Instructions, Example, & More

Web form 940 is due on jan. Select taxes from the sidebar menu. Web the federal unemployment tax act and the state unemployment tax act.

Most Employers Receive A Maximum Credit.

The futa tax is 6.0% (0.060) for 2023. Web you owe futa tax on the first $7,000 you pay to each employee during the calendar year after subtracting any payments exempt from futa tax. 31 each year for the previous year. If you owe less than $500 for any one quarter, you can.

You Had An Employee (Temporary, Part.

Web making payments with form 940 to avoid a penalty, make your payment with your 2023 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. Web you owe futa tax on the first $7,000 you pay to each employee during the calendar year after subtracting any payments exempt from futa tax. Web form 940 is a federal tax return required for most employers to calculate and report their federal unemployment tax liability for the calendar year. Only employers pay futa tax.

The Nfl’s Opener Will Be Between The Super Bowl Champion Kansas City Chiefs And Baltimore Ravens On Thursday Night In Week 1.

Only employers pay futa tax. The green bay packers know their first opponent and location: • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 940,” and “2023” on your check or money order. Web if you apply by mail, include:

Here Is The List Of Protentional Participants And Their Early Odds To Win.

Web form 940 vs. Use both tax forms 940 and 941, these forms have notable differences: The philadelphia eagles in brazil on friday night in week 1. This guide will discuss these taxes.

:max_bytes(150000):strip_icc()/IRSForm940-2036a6d75e47453db1b2c5ffc3418919.jpg)